Well 2014 was a great year! It went by way too fast for my tastes though. This year I switched to a new group at work, went to weddings 4 weddings, traveled to Boston, spent Thanksgiving in Mexico, attended a family reunion on the Oregon coast, moved in with my girlfriend, ran a half marathon and the Tough Mudder, started this blog, and I am currently spending some time with my brother and his family in Utah.

With the year over its time to review my budget and goals to see how I did.

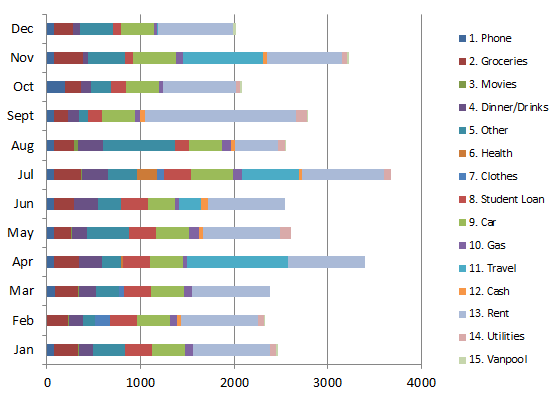

Income/Expenses:

My expenses are listed to the side. On each line I have the budgeted amount per month, the actual

amount spent for the year, and final the percentage of my yearly budget spent (where numbers greater than 100% means I spent more than my yearly allotted budget).

The Good: (Green)

Groceries, Movies, Healthcare, Student Loan, Gas, Travel, and Vanpool categories all came out under budget.

The Bad: (Yellow)

The following budgets were slightly over my yearly allotment (so calling them "The Bad" is an exaggeration):

- Phone: purchased a new $100 phone but averaged over the year it only put me a little over.

- Clothes: $3 over budget, I can live with that.

- Car: I did not factor maintenance into my budget so this went just slightly over.

- Rent: Slightly over due to moving expenses and incorporation of some utilities.

The Ugly: (Red)

The last set of budgets were definitely ugly, exceeding my planned budget by a wide margin.

- Dinner/Drinks: I think we went to a couple more expensive places then we should have this year otherwise I would have been fine.

- Other: This was my 3rd heaviest category, and is hardest to plan for because is covers a lot of random things.

- Cash: There were a couple of Craigslist items I purchased that required cash so this category was higher than I expected.

- Utilities: my worst category percentage-wise but this was due to me improperly planning my budget.

Despite some of my categories being so bad my good categories made up for it because my total expenses, $31,742, was actually $46 under my planned budget! The chart below shows my income over the year.

INCOME:

Paycheck: my net income for the year was $62,950.

% Expenses = 50% of income. Success!

Dividend Income:

Because I have been working hard on paying down my debts, I haven't been able to add much to my portfolio this year. But the great thing about dividend investing is that its still working whether I am adding to it or not. This year I earned $1,832 without lifting a finger, not bad. Here is a chart of my dividend income over the year:

Net Worth

Net worth will always be a secondary goal for me with generating passive income being my primary goal. But net worth is something I have started tracking. Given how much of my net worth is in stocks, my net worth will have a tendency to fluctuate frequently with the market but hopefully my net worth continue an overall upward trend over time.

Jan Dec

Assets: Assets:

- Cash $2,142 - Cash: $7,782

- 401k: $53,967 - 401k: $71,803 (+33%)

- 401k: $53,967 - 401k: $71,803 (+33%)

- Investments: $54,938 - Investments: $63,971 (+16%)

Liabilities Liabilities

- Student Loan 1: $20,051 - Student Loan 1: $0 (-100%)

- Student Loan 2: $7,410 - Student Loan 2: $6,866 (-7%)

- Car Loan: $11,995 - Car Loan: $9,150 (-24%)

NETWORTH: $63,317 NETWORTH: $127,540 (+103%)

Goals:

Time to see how I did on my 2014 goals.

- Spend less than 50% of my net income - COMPLETE - I squeaked in with $46 to spare!

- Pay off one of my student loans - COMPLETE

- Keep taxable income in the 25% tax bracket - UNCERTAIN - My current federal taxable income is $86,779 from my day job and considering dividends, capital gains, and interest I am about 99% of the way to the 25% bracket limit of $89,350 so this is really close, and I'm not exactly sure about how much my "other" incomes will amount to but I sold some stocks for a loss (ARCP) to make up some ground. I'll probably wait until I do my taxes to see how this one turned out.

- Weight under 200 lbs - INCOMPLETE - My current weight is 210 lbs and of late I have been gaining muscle instead of losing weight. I'll be changing this goal for 2015 to reflect body fat percentage.

- Run a half marathon - COMPLETE

- Complete the Tough Mudder - COMPLETE

- Work out my legs regularly - UNCERTAIN - This was a poorly worded goal as I have no way of measuring completion. I have been working out my legs more regularly of late though.

- Increase my running pace -UNCERTAIN - This was another poorly worded goal as I have no way of measuring completion. I have not been running lately because of all of my basketball games so I need to figure some way to incorporate running back into my routine, perhaps I will start running on the treadmill at the gym as a warm up before a workout.

- Take an online class -INCOMPLETE - I simply never found the time.

- Work through my backlog of magazines - INCOMPLETE - Unfortunately I still have as stack of magazines on my shelf.

How was your year?

Photo Credit: freedigitalphotos.net

No comments:

Post a Comment