Every month I start this post saying how fast time is going by and surprise surprise, November flew right by!

This is my 3rd monthly roundup and I hope to use these posts to discuss my current state of affairs including income/expenses, stock buys and sells, dividend income, and of course my progress on all of my yearly goals

Income/Expenses:

My expenses are listed to the side. On each line I have the budgeted amount per month, the actual

amount spent for the month of November, and finally the total amount spent in that category for the year. Those items in yellow have either exceeded or are in danger of exceeding the total amount budgeted for the year.

With my total expenses around $3200, which is certainly not my best month, in fact it was my second worst month of the year.

My grocery bill was higher than normal due to big a Costco run. My "other" category was also high due to a $150 purchase of a blender/food processor (I guess its a birthday present to myself) and another $150 purchase of a used phone for my girlfriend, as a Christmas present. My car budget was a little high due to new tabs for my car.

Travel

My travel budget is really what put me over the edge this month. I bought a $288 plane ticket for myself to go visit my brother (and more importantly my nephew) during New Years. As I mentioned in my last post we traveled to Mexico during Thanksgiving. My girlfriend ended up paying for the plane tickets and accommodations; I guess we were operating under the assumption that I paid for us to go to my friend's wedding earlier in the year so she paid for us to go to her friend's wedding. Regardless, because she paid for the hotel and travel I ended up paying for everything while we were in Mexico. I ended up spending around $560 in Mexico, $130 for the cooking class, $40 for boat tour and snorkel rental, and the rest on eating out, beer runs, and taxis. I am not too upset about what ended up paying because we had a great time but I do wish I had planned ahead and made a budget for what I expected to spend.

INCOME:

Paycheck: $4,904 .

% Expenses = 66% of income

Not good at all, and this brings my yearly expense rate over 50%. But luckily December happens to be a three paycheck month so beyond my obligatory monthly payments I have about $1000 for gas, groceries, eating out, vanpool, car maintainence, gifrts, etc. So I can meet my goal of keeping my expenses under 50% if I keep a careful watch on my expenses as the month progresses.

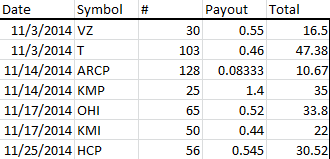

Dividend Income:

Because I have been working hard on paying down my debts, I haven't been able to add much to my portfolio this year. But the great thing about dividend investing is that its still working whether I am adding to it or not. This month I earned $196 without lifting a finger, not bad. The following companies paid me this month:

Buys/Sells:

November was another boring month for trading for me, this is due to me focusing on paying down my student debt.

FRIP

Scottrade offers a Flexible Reinvestment Plan, where dividends from qualifying companies can be used to purchase shares in any other qualifying companies without any commission. So I take advantage of this every month and I usually use it to build up my positions in companies where my positions are lagging.

This month my dividends were used to purchase 9 shares of Kimco Realty Corporation (KIM) .

Net Worth

Net worth will always be a secondary goal for me with generating passive income being my primary goal. But net worth is something I have started tracking. Given how much of my net worth is in stocks, my net worth will have a tendency to fluctuate frequently with the market but hopefully my net worth continue an overall upward trend over time.

Assets:

- 401k: $70,000

- Investments: $60,114

Liabilities

- Student Loan 1: $0

- Student Loan 2: $6,866

- Car Loan: $9,391

NETWORTH: $121,652 up 7% from last month, not bad

Goals:

- Spend less than 50% of my net income - This was a not good month and brought my savings rate down but I should still be able to meet my goal.

- Pay off one of my student loans - COMPLETE

- Keep taxable income in the 25% tax bracket - My current federal taxable income is $78,545 from my day job and considering dividends, capital gains, and interest I am about 89% of the way to the 25% bracket limit of $89,350 and we are currently 91% complete with this year. I have been watching this lately and I have had a good percentage of my income (20%) going towards pretax 401k.

- Weight under 200 lbs - My current weight is 208 lbs which is actually higher than last month's but my body fat % was actually lower so I've been making some progress. I don't think I will make my goal but I think I have been putting on muscle lately so I guess its OK. I'll have to revise this goal for next year.

- Run a half marathon - COMPLETE

- Complete the Tough Mudder - COMPLETE

- Work out my legs regularly - I have not been as good as I would like you to be but I have been better than in the past. This one still needs some work.

- Increase my running pace - I have not been running lately because of all of basketball games so I need to figure some way to incorporate running back into my routine, perhaps I will start running on the treadmill at the gym as a warm up before a workout.

- Take an online class - I have chosen a class but have yet to start, when will I find the time? I don't think I will get this goal done this year.

- Work through my backlog of magazines - I finished some of my other books so now I have more time to work through these magazines. My girlfriend would be very happy if I complete this goal, she's tired of the magazines lying around.

Photo Credit: freedigitalphotos.net

Hey Nick,

ReplyDeleteCongrats on paying off one of your loans man. You'll be less than 50% expense rate in no time! Look forward to following you on your journey.

Regards, Sam

Thank! Yes it is definitely good to take one step farther out of debt and as long as I take control this month I will definitely meet my expense rate goal.

DeleteThanks for stopping by!